April 14, 2022

At the limits of energy efficiency policy, energy providers see opportunity

Energy providers have spotted an opportunity in the heat pump sector after the UK released its much criticised energy strategy, but investors may need some convincing

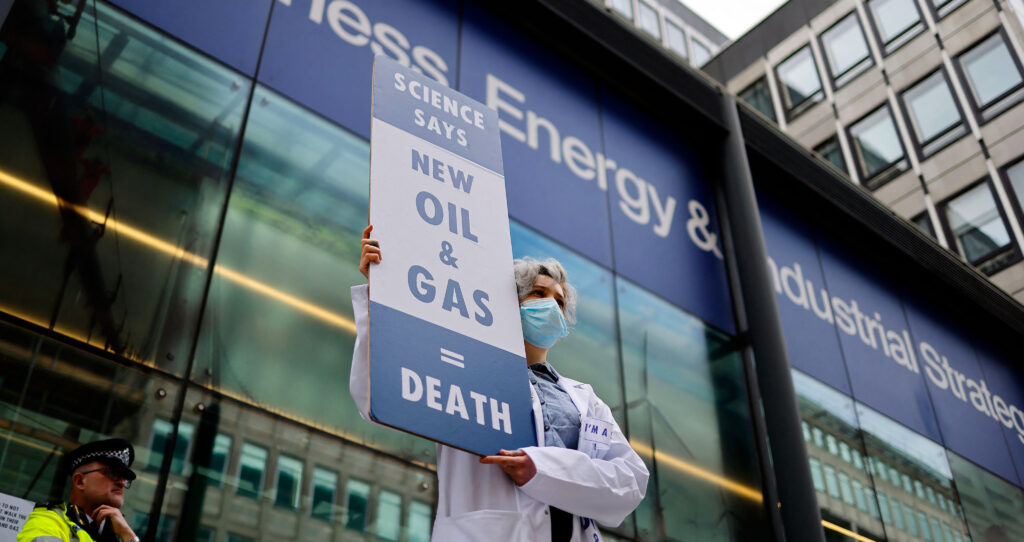

Campaign group Scientists for Extinction Rebellion says the British new energy security strategy (ESS) has betrayed its climate ambitions, with members glueing ...

Already a subscriber? Log In

Read Next:

April 16, 2024

Why cash, not regulation, may hold key to halting deforestation

With some areas suffering record losses, it appears paying people not to cut down trees might be the best way to keep the world’s remaining forests safe

Read more