January 12, 2022

Sustainability-linked derivatives markets primed for growth

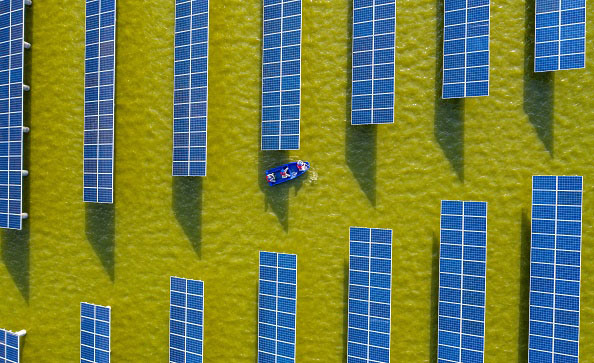

Derivatives with sustainability targets attached to them are becoming more common, but are they really an effective tool for improving a company’s sustainability? Marie Kemplay reports on structuring and regulatory considerations Following in the footsteps of their cousins in the loan and bond markets, derivatives are the latest financial product...

To continue reading

Request Free Trial- Unlimited access to all content

- Email alerts highliting key industry insight.

- Invitations to attend exlusive roundtables and events.

- The Sustainable Views Policy Tracker - deep insight on ESG regulations and deadlines

Already a subscriber?Log in

Similar Articles

In Brief: EU directs funds to sustainable fisheries; ethical tax standards released

The latest ESG policy and regulatory news

read more

April 18, 2024

Opponents of mandatory Scope 3 reporting are ‘confusing the symptom for the cause’

Regulation making it mandatory to report upstream and downstream emissions will make life easier, not harder, for companies, argues the EDHEC-Risk Climate Impact Institute

read more

April 17, 2024

Executives expect half of their supply chains to fall foul of CSDDD

Despite EU policymakers agreeing a watered-down version of the EU Corporate Sustainability Due Diligence Directive, business leaders are not confident their supply chains will meet its requirements

read moreA service from the Financial Times