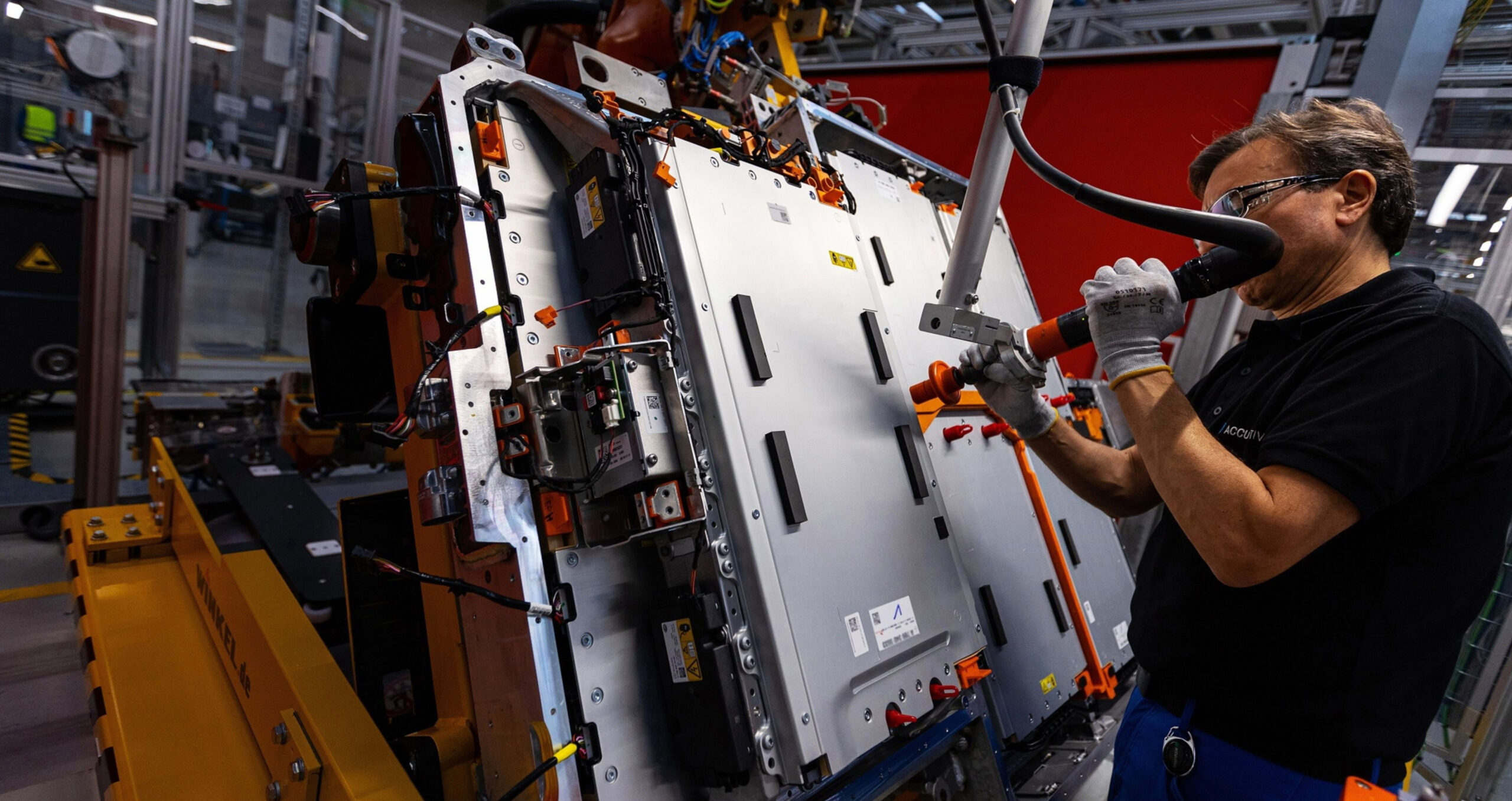

The US hopes a generous tax credit incentive will spur electric vehicle battery manufacturers to start locating sourcing and production facilities in North America.

The US is attempting to wrestle control of the electric vehicle battery supply chain away from China, and its weapon of choice is the Inflation Reduction Act. But imposing regulations on a sprawling and complex part of the global economy is a major challenge. Despite US regulators’ clear intentions, there is still uncertainty over which countries and companies stand to gain.

To continue reading

Request Free Trial- Unlimited access to all content

- Email alerts highliting key industry insight.

- Invitations to attend exlusive roundtables and events.

- The Sustainable Views Policy Tracker - deep insight on ESG regulations and deadlines

Already a subscriber?Log in

Similar Articles

May 3, 2024

In Brief: EU Council approves two-year delay to parts of CSRD, ISSB publishes digital taxonomy

The latest ESG policy and regulatory news

read more

April 30, 2024

Pressure mounts on California’s Gavin Newsom to fund climate legislation

California governor and Democrat Gavin Newsom approved two landmark climate bills last year, but neither have been allocated funding in the state budget — yet

read more

April 26, 2024

In Brief: EU parliament rubber-stamps CSDDD; US imposes strict rules on carbon pollution from power plants

The latest ESG policy and regulatory news

read moreA service from the Financial Times