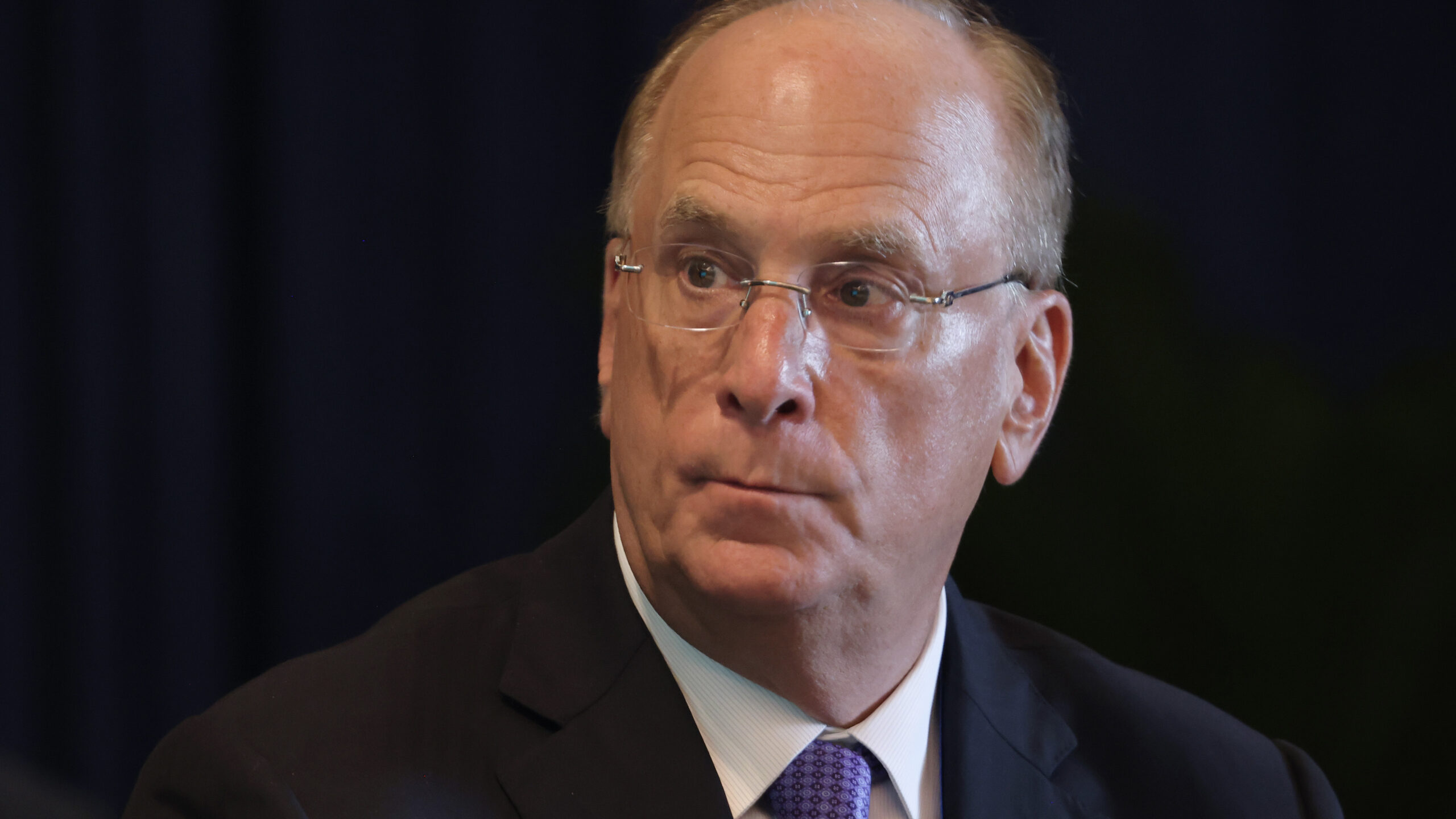

Why Larry Fink’s ‘energy pragmatism’ is a push for the disaggregation of ESG

As we transition to a more sustainable economy, companies, investors and regulators will be better served by pragmatism than perfectionism

Larry Fink’s 2024 letter to investors takes a personal note in its tackling of global issues as he compares today’s world with that of his parents’ generation.

Although the BlackRock chief executive touches on similar themes to previous years – such as retirement, demographics, and energy – this year’s letter is underpinned by two defining axes: trust and disillusionment and, more fundamental still, hope and fear. Fink explores how these factors impact economic decisions and the outlook for America’s, and the world’s, future.

The environmental, social and governance industry cannot read Fink’s letter without acknowledging the continued absence of the term “ESG”. With a clear nod to various US stakeholders given the shift in debate around ESG, he takes the opportunity to underscore, again, that BlackRock’s key role as an asset manager is to meet its clients’ needs and follow its clients’ mandates.

Like the leaders he met in 2023 when travelling the world, he brings home the message that BlackRock sees a need to be pragmatic rather than dogmatic – about energy specifically, but also about a whole host of other ESG issues.

However, while the actual acronym may be missing, much like last year, its underlying principles are embedded throughout the letter when discussing the energy transition, energy security and the issue of ensuring a fair transition, with a nod to human rights and other social issues.

Story about retirement

In fact, Fink’s letter is anchored in a story about retirement – linked, of course, to pension funds around the world that entrust their money to asset managers such as BlackRock.

With an inherently long-term investment horizon, pension funds, and the asset managers who serve them, will want to assess a company’s business conduct and governance, including environmental protection and human capital management, as part of their fiduciary duty. And companies will want to include the relevant material topics in their strategy and business operations to help ensure they are considered a good investment, not just today but also tomorrow, during the transition to a more sustainable world.

While Fink’s 2022 letter to shareholders and 2023 letter to investors focused on the net zero transition and the global energy transition, 2024’s letter debuts his latest nomenclature: energy pragmatism.

The concept of pragmatism is increasingly prominent in sustainability issue discussions. From the imperative shift towards clean energy, as referenced by Fink, to the EU’s acknowledgment of “shades of brown” in its journey towards a greener economy, and even in the allowances for regulatory delays to facilitate companies’ adaptation, pragmatism is emerging as a guiding principle.

As the world has swiftly moved from commitments and theory to action plans and implementation, there seems to be a critical mass of understanding that we will need to be pragmatic – balancing the need to progress swiftly on sustainability issues during a time characterised by macroeconomic uncertainty and geopolitical concerns. And indeed, as we transition to a more sustainable economy, companies, investors and regulators are all better served by pragmatism than by perfectionism.

Open-minded approach

Pragmatism enables a flexible and open-minded approach amid fast-moving developments, without reducing ambition when it comes to achieving sustainability goals. For example, if new data shows that a proposed solar energy project has a high risk of harm to biodiversity and poor working conditions, companies and investors need to be agile and act with broader business conduct in mind to reduce this risk.

This approach enables companies and investors to make confident business decisions to mitigate risk, and seize opportunity, in a more realistic way to support long-term sustainability goals, with impact on people and planet included in the decision-making process.

This shift towards pragmatism is accompanied by a move towards the disaggregation of ESG data – or, as it could also be called, business conduct data. Regulations are disaggregating and becoming more targeted – covering human rights, biodiversity, climat, and more.

Data providers are selling fewer aggregated ratings and more granular data because investors are becoming more sophisticated and disaggregating ESG themselves to gain refined clarity over their portfolios and to meet specific and evolving client needs.

In navigating the energy transition – and a fair transition – investors and companies are increasingly tailoring ESG criteria to their regional and sectoral contexts, crafting customised metrics, which empower them to make pragmatic decisions grounded in confidence to mitigate risk and seize opportunity.

While there may be debates about nomenclature, ESG in some shape or form is here to stay. Ultimately, the principles of ESG are linked to a company’s operational excellence and its ability to be future-proof in a changing world.

Alexandra Mihailescu Cichon is chief commercial officer at RepRisk

Similar Articles

Editor’s note: UK local elections and climate action

Why local elections can change the course of climate action