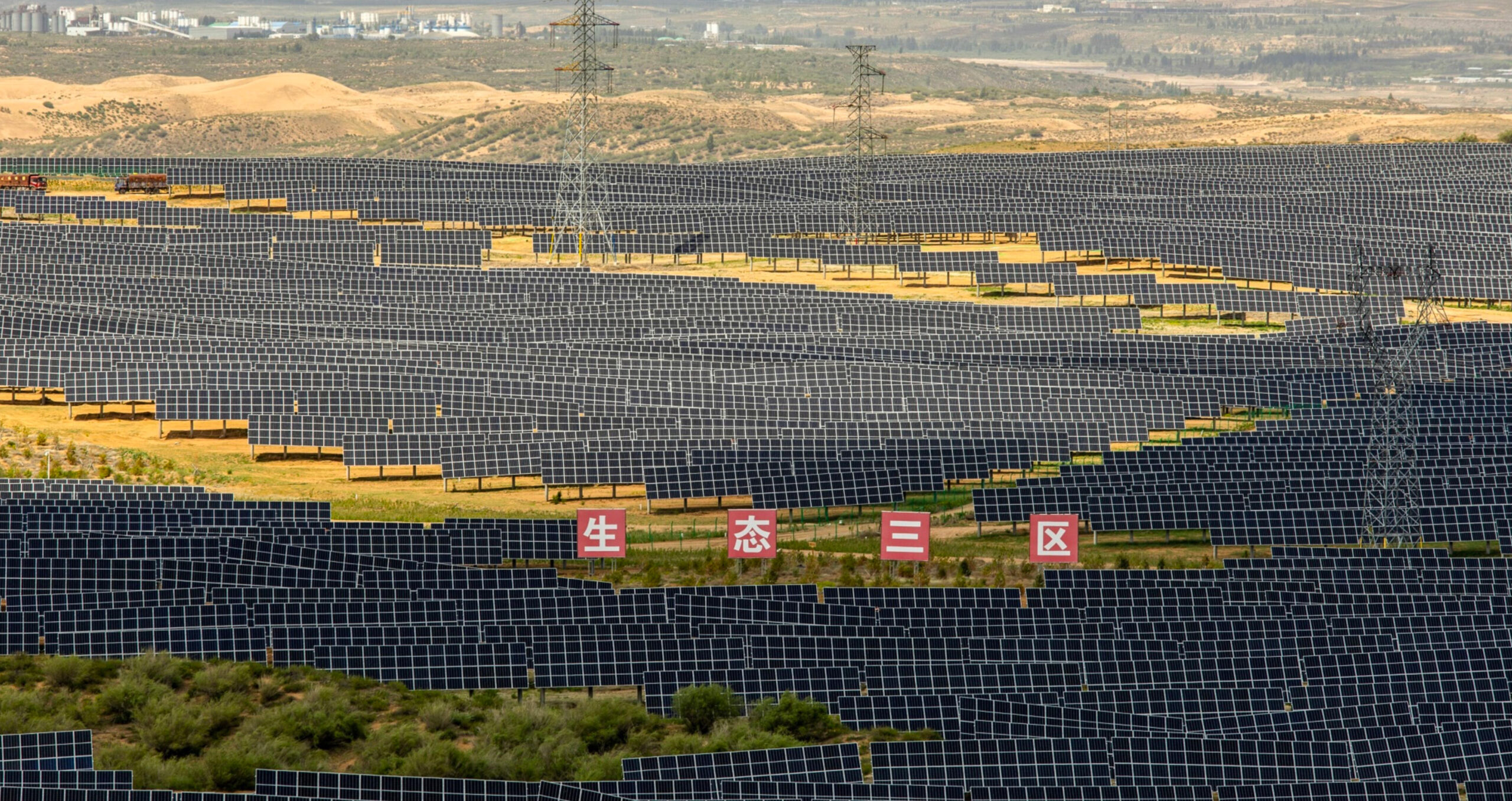

Beijing is taking steps to bring its voluntary carbon market in line with Paris Agreement commitments

China is overhauling its voluntary carbon market to meet international standards, accelerating the government’s drive towards net zero climate targets and opening the door for cross-border trading opportunities.

To continue reading

Request Free Trial- Unlimited access to all content

- Email alerts highliting key industry insight.

- Invitations to attend exlusive roundtables and events.

- The Sustainable Views Policy Tracker - deep insight on ESG regulations and deadlines

Already a subscriber?Log in

Similar Articles

April 17, 2024

IETA challenged over carbon credit use for short-term corporate emissions targets

Campaigners suggest carbon credit guidance from International Emissions Trading Association ‘disincentivises emissions reductions’

read more

April 11, 2024

SBTi staff demand CEO resignation over plans to extend carbon credit use for Scope 3 emissions

Concern and confusion cited by staff at the Science Based Targets initiative, while carbon market companies back Scope 3 changes

read more

April 3, 2024

Market uncertainty as Australian government delays updating carbon accounting method

Australia’s integrated farm and land management methodology would combine various approaches to capturing and storing carbon, but there are fears it could lead to confusion

read moreA service from the Financial Times