In Charts: Energy transition brings back strong mining investment

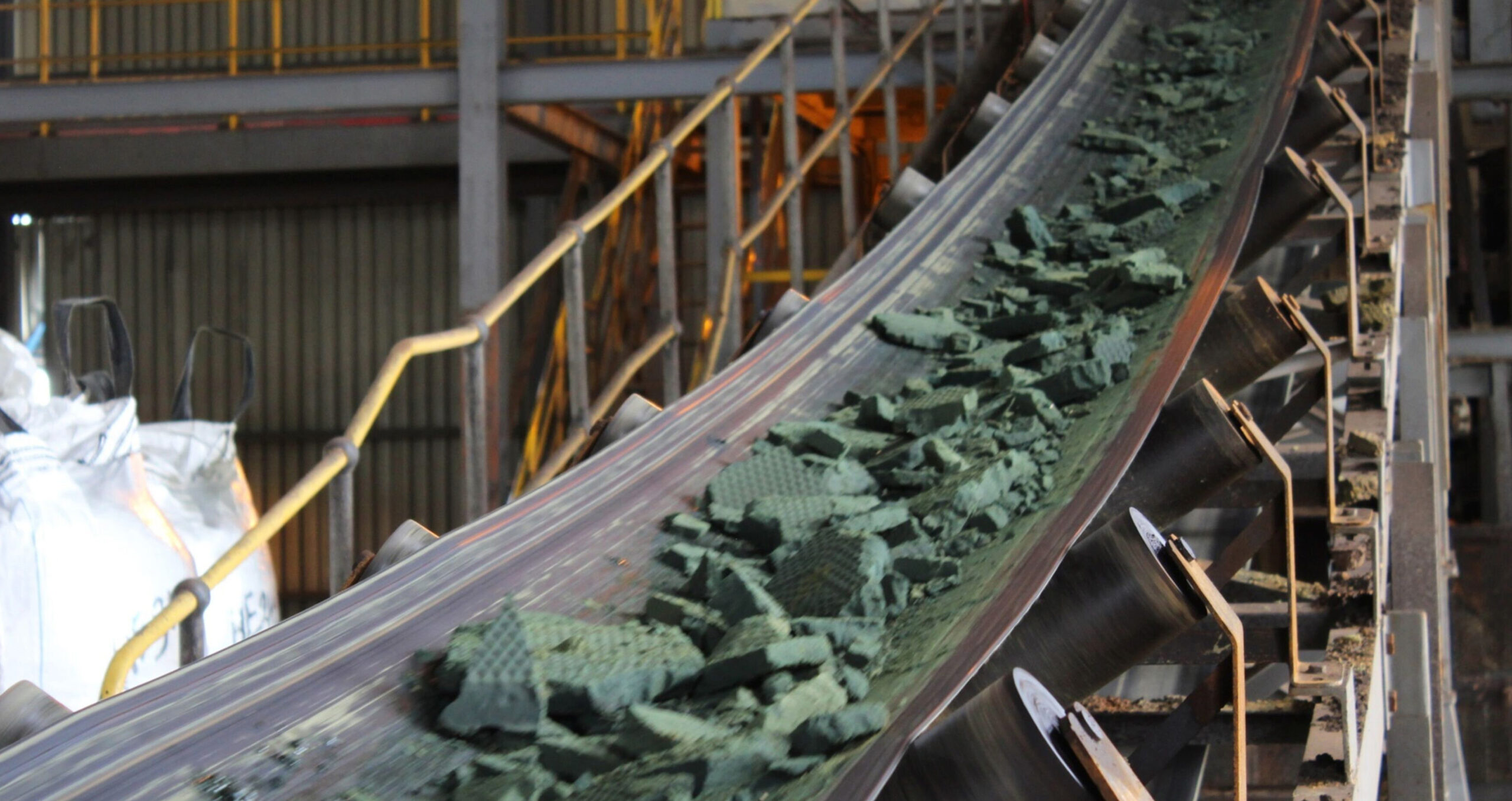

Soaring demand for critical minerals drives more capital deployment by the world’s largest miners.

Global mining investment rose to its highest level for almost a decade last year amid higher demand for lithium, copper and other critical minerals needed for the energy transition.

The world’s top 40 mining companies by market capitalisation invested about $85bn worldwide in 2022, up by 19.7 per cent from the previous year, according to a report published in June by consultancy PwC. This was the highest level of investment since 2014, when $93bn was deployed by the top 40 miners, but still below the all-time high of $169bn recorded in 2012.

As is typical of mining’s cyclical nature, these higher investing activities have followed higher commodity prices. Despite falling from a peak of 227.92 in March 2022, the International Monetary Fund’s monthly price index of energy transition metals – which includes lithium, cobalt, nickel, copper and other critical minerals – stood at an elevated level of 178.06 in December 2022.

Exploration spending in 2022 by the world’s top 40 mining companies – which is included in overall investing activities – reached its highest level since 2013, according to PwC analysis. Data from the International Energy Agency shows that exploration spending on lithium almost doubled to $467mn last year and copper saw spending jump to $2.8bn.

The uptick in overall mining investment has been driven by demand from the transition to electricity-based technologies, which require large amounts of copper, lithium and other minerals. But analysts caution that mining investment remains well below the levels needed to meet projected demand from the transition away from a fossil fuel-based economy.

The IEA estimates that the global economy will require six times more mineral inputs in 2040 than currently in order to reach net zero by 2050. Data from fDi Markets shows foreign direct investment into the manufacture of battery and electric vehicles still far exceeds capital deployed into the mining of critical minerals used in their production.

Elisabeth Hunt, a sector leader for energy and resources at PwC UK, says that excitement around critical minerals has helped attract capital from non-traditional sources into early-stage mining investments, including from automotive original equipment manufacturers and governments.

A drive to secure supplies for the energy transition has led governments like the US, the EU and the UK to sign partnership agreements with friendly resource-rich countries and incentivise mining investment and exploration through grants, loans and tax breaks. In this climate, mining companies have raised $550mn in venture capital funding so far this year, up from $508mn raised in the first three quarters of 2022, according to PitchBook.

“Financial availability, combined with projections of mineral shortages and associated price responses favouring forward valuations, has led to start-ups and small miners being better able to secure initial funding rounds at higher prospective valuations,” says PwC UK senior manager John Mullins.

However, it is not all plain sailing. Campaign group pressure and a historical lack of adherence to environmental, social and governance principles by some miners has made obtaining a licence to operate a new mine convoluted and time-consuming. “The need to obtain minerals for ‘the common good’ is colliding with the general opposition by many communities to mining happening in their backyard,” says Hunt.

It also takes many decades to explore for metals and bring mines into production. Hunt notes there is a risk that recycling becomes increasingly dominant as a supply source and demand for mined metals falls. “This may leave an overhang of investment which will depress prices and asset values,” she adds.

This article was first published in fDi Intelligence

Similar Articles

In Charts: 8 out of 10 companies not subject to EU’s CSRD still intend to comply

In Charts: MDBs to support emerging markets climate finance push, predicts Fitch